Up and down for Vegas

If you say the word “casino” to people in the Western world, they are probably most likely to think about the bright lights of Las Vegas. However, as you move further East across the globe, the chances are that same word will conjure a very different image – one of Asian gambling capital Macau.

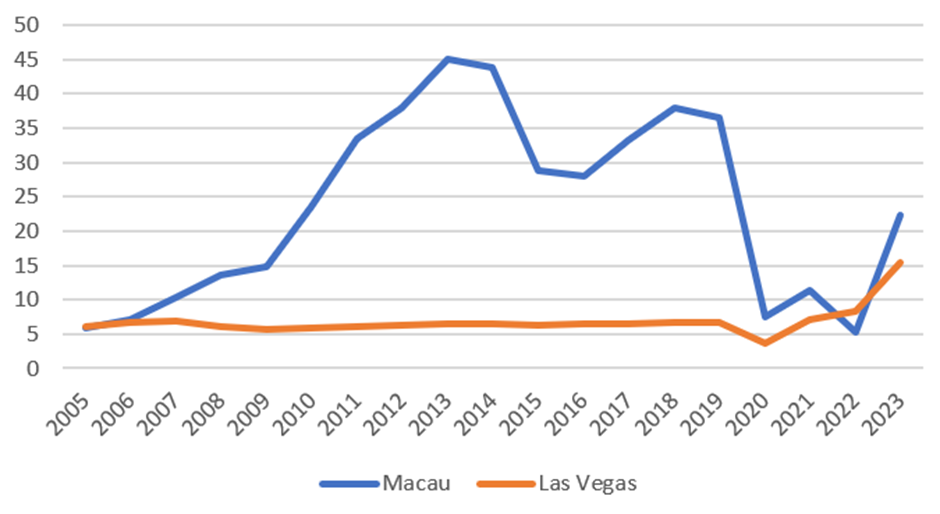

In fact, if we are taking the size of the market into consideration, everyone should think of Macau first. The Special Administrative Region (SAR) of China beat Las Vegas in terms of gross gaming revenue (GGR) every year between 2005 and 2021, and not by small change either. At its height in 2013, Macau GGR was more than $30bn higher than Las Vegas.

Macau was able to reclaim its crown in 2023, beating Las Vegas by $6.8bn

That all changed in 2022 when Las Vegas GGR surpassed Macau for the first time since 2005, thanks mainly to a quick turnaround from the restrictions of the COVID-19 pandemic. While it was a momentous occasion for the Nevada gambling hub, it was also short lived. Restrictions eased in China and Macau was able to reclaim its crown in 2023, beating Las Vegas by $6.8bn.

In 2024, it seems that gap could widen even further, with Macau already $3.21bn ahead after just one quarter. Impressively, this continued post-Pandemic recovery comes despite a new non-gaming focus ordered by the top of the Macau government.

No more casino focus

Macau Chief Executive Ho Iat Seng announced a new strategy for the SAR in early 2023. Instead of focusing on gambling, as it has for decades, Macau will direct its attention towards tourism, healthcare, finance, technology, and large-scale events. The economic diversification plan will run from 2024 to 2028.

So, what would be the reason for the move? Well, the big clue is that the plan comes just after the COVID-19 pandemic. Macau’s casinos have been out of action for long periods since the beginning of the crisis in 2021 and have only just begun to return to their former glory. This has prompted the government to seek a better way of doing things, and it has already had a substantial impact.

the gambling industry’s share of the Macau gross domestic product (GDP) in 2023 was less than 40%

Ho reported on Sunday that the gambling industry’s share of the Macau gross domestic product (GDP) in 2023 was 36%. That is almost exactly in line with the 60% non-gaming target of the government, established in that first announcement. It represents a significant drop from the 50% share the industry held in 2019, the year before the pandemic.

In addition, there is now pressure on gaming companies to increase their non-gaming investment as part of their freshly-signed concessions. Wynn Resorts International has already begun, announcing this month that it intends to invest $2.2bn in Macau over the next decade, primarily on non-gaming and international market expansion.

The war rages on

The big question is, what does this all mean for the battle for global gaming dominance? It’s still headed in the right direction for Macau, despite the drop in gaming reliance.

Macau has already generated $7.06bn in the first quarter of 2024, up 6% quarter-on-quarter. In light of this performance, brokerage firm CLSA has updated its GGR forecast for the gambling hub in 2024, now expecting it to reach $30.3bn. That would put it 36% above 2023.

Nevada hit its 25th straight month of $1bn+ GGR in March

What is also clear is that Las Vegas is headed the right way too. Nevada hit its 25th straight month of $1bn+ GGR in March, indicating that it has now cemented its position as a billion-dollar market. March actually marked the first year-on-year decline in Las Vegas GGR in eight months, but it still saw $1.22bn in revenue. That brought Q1 GGR to $3.9bn, up just over 2% y-o-y.

While the focus on non-gaming has so far not hindered Macau’s progress, it may eventually mean that GGR will sit at a lower base line that it has in the past. If it continues to follow its own upward trajectory, Las Vegas may even join its Asian counterpart in the lofty heights, making the competition a little closer. But for now at least, it is definitely a one horse race once again.