From hero to zero

It’s fair to say 888 Holdings is already having a 2023 to forget. In fact, the online casino and sportsbook operator has struggled with numerous issues for more than 12 months now, so much so that it recently lost its place in the FTSE 250 index for the London Stock Exchange (LSE).

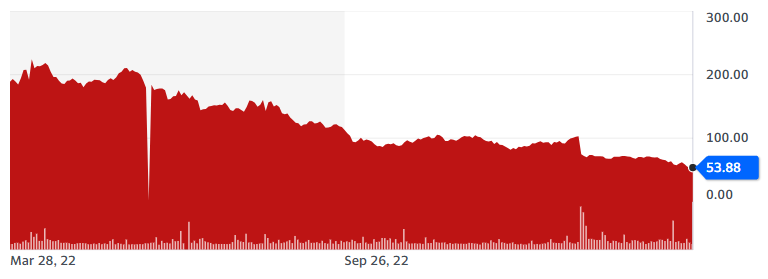

the 888 share price has fallen to just £53.88 ($66.33)

If that name is alien to you, the FTSE 250 comprises of 250 UK-based mid-market cap companies. 888 is no longer considered one of the lucky few after its shares dropped 72% in only 12 months, not to mention 48% in the past three months. At the time of writing the 888 share price has fallen to just £53.88 ($66.33), while the company has a market cap of £253.9m ($312.69).

When it entered the FTSE 250 in June 2020, 888 seemed a company on the rise with little sign of slowing down. The share price grew to a staggering height of £458 ($562.12) in September 2021 – it’s highest point in history and 88% greater than its price today. What followed was a serious downfall seemingly sparked by a major acquisition.

888 got in trouble in the Middle East, lost its CEO, waved its white flag in certain US sports betting markets, and now has to pay the largest fine in UK history. Where did all go wrong?

The spark to the flame

In September 2021, 888 secured the rights for the non-US assets of UK-based sportsbook operator William Hill for £2.9bn ($3.47bn). The company defeated private equity firm Apollo Global in a bidding war for the Caesars Entertainment-owned assets, which included 1,414 retail betting shops across the UK, in addition to online brands.

a whopping £1.76bn ($2.16bn) worth of debt

While this might seem like a sound investment for a company such as 888, the firm actually purchased those assets with money it didn’t have. The group announced that it would have to enter into a whopping £1.76bn ($2.16bn) worth of debt in order to complete the deal. This involved more than £1bn ($1.23bn) in senior secured indebtedness, as well as term loan A facilities, and a multi-currency revolving credit facility.

If you think that sounds messy, you’re right. Of course, this led to an increase in interest rates for the company, which had by this point admitted that its net debt was “higher than anticipated.”

To quell investor concerns over this, the company announced plans to slash the debt to 3.5 times earnings by the end of 2025 through “an extremely disciplined approach.” As part of this plan, execs decided to exit online sports betting-only states in the US, focusing instead on those that also have iGaming.

Despite 888’s promises and the action taken to fulfil them; analysts continue to have concerns over the company’s debt position. This remained at £1.8bn in the last reported quarter in 2022. Viewing the company’s share price since September 2021, it’s clear to see that investors share the concerns of analysts.

Trouble in the Middle East

As if the company’s debt troubles weren’t enough, 888 has found itself in hot water multiple times this year. The first of those occasions related to its VIP operations in the Middle East, where a probe revealed that the firm might not have followed best practices in relation to anti-money laundering and know-your-customer systems.

888 has since suspended its VIP operations in the region, with company chair Lord Jonathan Mendelsohn asserting that the firm’s execs “take compliance responsibilities incredibly seriously.” It’s a measure that the company’s board said would have an impact on less than 3% of total group revenue or around £50m ($61.38), but damage to the company’s reputation is far greater.

Out with the old

Not only did the Middle East situation come at the detriment of finances, it also cost the firm its leader. Itai Pazner stepped down from his position as chief executive of 888 shortly after the news broke, suggesting that he had taken the brunt of the blame. Pazner had worked at the company for more than two decades, serving as CEO for the past four years.

Shares fell 27% upon announcement of the news

As you would expect, Pazner was the driving force behind many of the deals 888 made in that time, and he always affirmed that he “absolutely did not” have any buyer’s remorse over William Hill. With the man who had guided the company onto its current path now away from the steering wheel, investors lost further faith. Shares fell 27% upon announcement of his departure.

In order to steady the ship, 888 chief financial officer Yariv Dafna confirmed that he intended to stay at the company until the end of 2023. He initially announced his intention to leave following disappointing results in 2022. Meanwhile, Mendelsohn has taken over as executive chair on an interim basis while the board searches for a new CEO.

Since the changeover at the end of January, shares have tanked 48%.

The icing on the cake

With all of these issues to deal with, you might be wondering how it could possibly get any worse for 888 in 2023. Well, securing the largest fine in UK gambling history would certainly do the job.

On Tuesday, the UK Gambling Commission hit William Hill with a record fine of £19.2m ($23.6m). In its investigation, the regulator found major issues with the operator’s money laundering policies and affordability checks for new customers. In one instance, a William Hill user bet £23,000 ($28,282) in just 20 minutes without adequate checks.

888 had put away £15m ($17m) to cover the cost

Although the fine is substantial, it’s actually less than many predicted. In early March, sources suggested that 888 would receive a fine of £20m+ ($17m) for the William Hill failings. In anticipation of the penalty, 888 had put away £15m ($17m) to cover the cost, according to the Daily Mail. Much to the ire of already flustered investors, we now know that the firm will have to fork out more than that.

Rumors of an impending fine mean 888’s shares have been dropping since the beginning of early March, tanking around 24% from the day the news broke in the mainstream media. When the actual cost was confirmed on Tuesday this week, that price fell a further 4%.

With a record multimillion-dollar fine just the icing on the cake for a difficult start to 2023, 888 execs and investors will likely be looking towards the rest of the year with dread. However, in the timeless words of D:ream: “Things can only get better.” Right?