A second attempt

A new bipartisan proposal in Congress aims to get rid of the 0.25% federal excise tax on sports bets. It also seeks to eliminate the requirement that sportsbooks pay an annual charge of $50 per employee to the federal government.

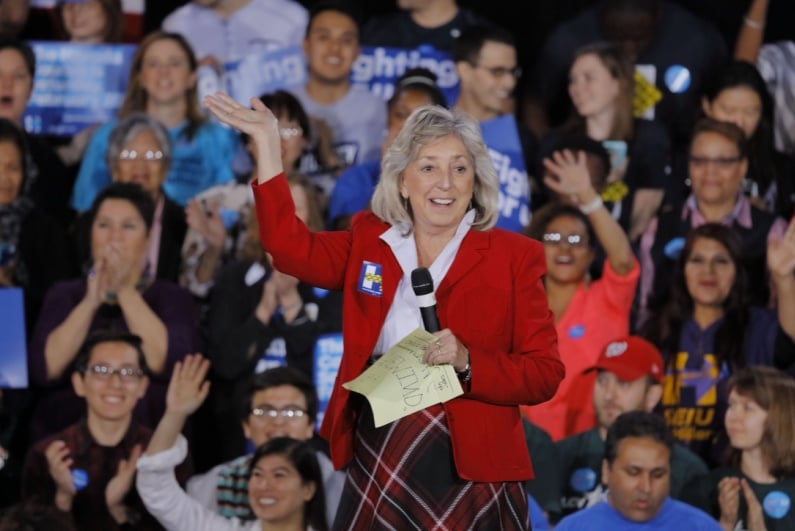

Representatives Guy Reschenthaler (R – Penn.) and Dina Titus (D – Nev.) introduced their legislation on Thursday. They are the chairs of the Congressional Gaming Caucus, which acts as a way for gambling-related operators to have their opinions heard on Congressional issues. A similar type of bill from the pair was unsuccessful last year.

goal of the tax was to help battle against illegal gambling operations

This excise tax first came into place in the 1950s and many non-exempt operators are still making these payments. The original goal of the tax was to help battle against illegal gambling operations. The likes of state lottery-operated sportsbooks and horse racing operators are not subject to this handle tax.

Aims to help legal operators

Sports betting operators in Nevada contributed more excise taxes than those in any other state in 2019. The state’s payments totaled $13.3m, yet the IRS was unable to answer how it was using these funds when Representative Titus inquired. She said: “The handle tax punishes legal gaming operators and encourages consumers to place bets illegally.”

As legal sports betting spreads across the United States, Titus believes that getting rid of the excise tax will help with job creation. Representative Reschenthaler believes that the excise tax is a penalty on legit sportsbook operators and gives an unfair advantage to illegal betting operators. With the COVID-19 pandemic being particularly tough on land-based casinos and retail sportsbooks, he believes that eliminating these federal taxes will aid in the recovery.

AGA supports the proposal

The American Gaming Association (AGA) has expressed its support for the bill. AGA president and CEO Bill Miller outlined in a statement how the original introduction of the handle tax was to fight against illegal operators, but these are the parties who are now benefiting. He went on to say that if Congress wanted to support the burgeoning legal sports betting sector that it would “eradicate this unnecessarily burdensome tax to level the playing field for legal sportsbooks.”

Both Titus and Reschenthaler attempted last July to push through similar legislation, but HR 7790 was unsuccessful. At the time, the AGA argued that the $33m that the handle tax generated in 2019 was not meaningful revenue for the federal government.

Opponents of the proposal believe that the excise tax rate is properly sized to allow the federal government to earn some revenue from betting without it being too penalizing on operators.