Italian government plans more gambling restrictions

There will potentially be a higher gambling tax rate for big jackpot winnings, and a ban on using cash in retail betting stores as part of Italy’s new government plans.

The changes have been included in the fiscal budget for 2020, and will see the tax rate on lottery jackpots of more than €100m ($110m) rise from a previous rate of 12% to 23%. It was only recently that someone won the €209m ($230m) jackpot for the SuperEnalotto. Under this potential new tax rate, the Italian government will be able to claim €48m ($53m) of such a sum.

tax rate on lottery jackpots of more than €100m ($110m) [will] rise from a previous rate of 12% to 23%

While Italy only has a few lottery jackpots of this size each year, the government is also going after smaller lottery winnings, according to the proposed plans.

Introduction of gambling tax on winnings

The Italian government has plans to bring in a completely new gambling tax on winnings of less than €500 ($551). This would see most gambling-related winnings in the country being taxed. All forms of gambling, from sports betting to lotteries, would be subject to this new taxation.

The tax rate would be variable, depending on the size of the winnings. It looks set to begin at 12% and go as high as 23%.

Local media question move

Local media in Italy believe the government will actually collect less revenue from gambling as a result of this potential new tax.

According to media reports, this should lead a lot more people to decide to just keep their winnings and not repurchase additional lottery tickets.

Potential ban on using cash to bet

The Italian government is also looking at banning the use of cash when wagering at retail betting stores. This would be an attempt to battle tax evasion. Gamblers would have to use debit or credit cards to place bets at retail facilities.

The president of local gaming industry group STS, Giorgio Pastorino, spoke out against this potential cash ban. He believes such a move will only benefit financial institutions and has questioned why the government thinks a gambler will want to play a game for €1 ($1.10) by using their card.

Operators, he added, will also not want to accept card payments for such small stakes, so as not to incur the percentage cut that card issuers take from every transaction.

Government happy to decrease gambling activity

Even if people in Italy spend less on gambling and tax revenue is lower as a result, the government will still be meeting its goal of reducing gambling in the country.

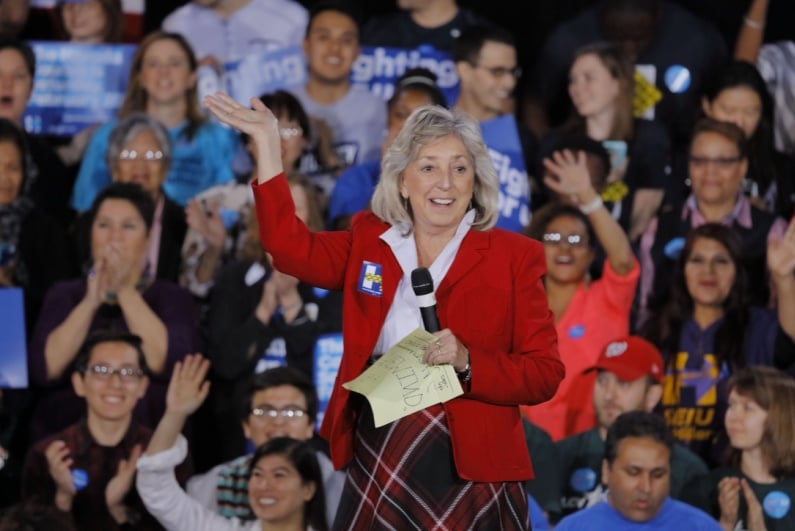

Laura Castelli, the Deputy Minister of the Economy, said recently that the government’s “virtuous” battle against the gambling sector will keep moving “forward, not backwards”.

Since Italy’s coalition government came to power in spring 2018, it has introduced numerous restrictions on the country’s gambling sector. This has included a ban on all forms of advertising from gambling companies, including sport sponsorships.

The government also brought in heavier taxes on the revenues of gambling operators across both retail and online settings. It sees gambling as a significant drag on society and aims to reduce as much as possible the activity centered around.